Betwixt and Between

The second quarter stock market rally continued throughout the third quarter of 2025, led largely by two key drivers, the continuing boom in artificial intelligence (AI) and the Federal Reserve’s long-awaited interest rate cut. Market enthusiasm and enormous corporate capex (capital expenditure) in the multi-layered AI infrastructure remained central, as corporations kept embracing AI as a cost-cutting and efficiency-improving initiative. The Fed’s 0.25% (25 bps) cut in late September was the first reduction of interest rates after a lengthy pause, spurring market optimism and providing an additional catalyst to the rally.

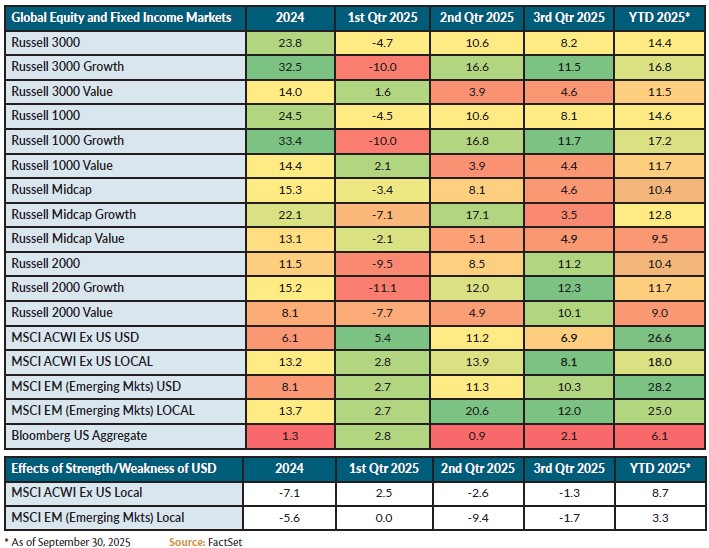

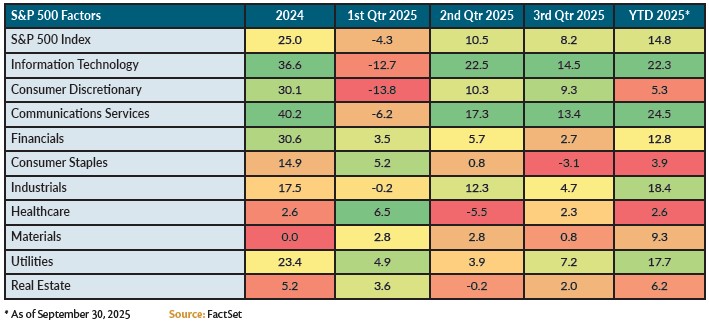

The Information Technology and Communication Services sectors were the biggest winners domestically in the quarter, fueling the rally and leading markets to new highs. Names like Nvidia, Apple and Alphabet contributed handily to market gains in Q3, as large cap growth stocks (Russell 1000 Growth), especially those associated with AI, outpaced their large value counterparts (again). Small cap US stocks (Russell 2000 Indices) also enjoyed a strong quarter. Often viewed as more sensitive to interest rate changes because much of their debt is floating rate, the Fed’s rate cut, and the expectation of more cuts provided a tailwind to small cap performance. International markets, particularly the emerging markets, also outperformed as they benefited from easing monetary policy and a weakened US dollar. Bonds delivered positive returns as falling interest rates pushed bond prices higher.

The heatmap below (green higher returns & red lower returns) shows asset class and market sector performance variances for recent quarters, current quarter and year-to-date (YTD) through September 30, 2025:

As we begin the last quarter of the year, the market outlook is distinguished by competing strengths and weaknesses. Here are some themes and key elements going forward:

ECONOMIC AND POLICY – the market is walking a tightrope between nagging inflation (potentially aggravated by tariffs) and a forecasted slowdown in economic growth. The risk of slow growth with high inflation (stagflation) remains low, but any combination of conditions that might cause the Fed to reverse course because of stubbornly high inflation would negatively impact the markets. Concerns over rising fiscal deficits and elevated debt levels are putting upward pressure on long-term bond yields, making fiscal sustainability another notable risk factor. US trade policy and tariffs are also significant wildcards, creating uncertainty for global trade and continuing to drive goods inflation. Lower US interest rates, tariffs and trade policies have also weighed on the US Dollar, temporarily weakened relative to other major foreign currencies. Even so, the Dollar’s unmatched scale, liquidity and network effects thwart any attempts to diversify away from its dominance as the reserve currency of the globe.

INVESTMENT – the AI build-out continues to be the dominant growth theme in investment markets. It is driving massive capital expenditures and productivity gains and is clearly propping up the markets. Often likened to the “Internet Bubble” of the late 1990’s, today’s AI revolution differs in that the major players driving growth are built on solid financial foundations. Both eras shared a common thread of technology-driven hype and soaring valuations; however, most of today’s companies exhibit real financial strength, maturity and core profitability. The risk lies in the extreme market concentration in a handful of tech stocks, leading to concerns about stretched valuations and a potential “bubble-like” environment. As a result, diversifying portfolios into pockets of value that have lagged the main rally is prudent. Investments in small cap stocks, value stocks, undervalued sectors like healthcare and international stocks all present reasonable opportunities for future appreciation.

Our outlook is characterized by a balance of optimism from continued AI-driven growth and anticipated central bank easing, juxtaposed against the headwinds of high valuations, fiscal deficits and trade uncertainties. Flexibility and diversification – core tenets of ours – will be emphasized as critical to navigating the higher market volatility expected in the near-term.